West Bengal Bhabishyat Credit Card Scheme

West Bengal Bhabishyat Credit Card Scheme Online Form Filling, Project report Ready & Support

₹499.00

Required Documents

Pan Card

Aadhaar Card

Voter Card

Business Project report

Udyam Aadhaar Certificate

Trade Licence

Passport Size Photo

Signature

Bank Passbook

About WBBCCS

West Bengal holds an excellent track record in the development of MSMEs including handloom and handcrafts. Almost 99% of total industrial undertaking belongs to MSMEs sector and again 98% of MSMEs are micro enterprises. A significant number of educated youth of the state who have entrepreneurial skill and want to be self-reliant by setting up micro enterprises have limited access to institutional finance for their credit needs.

Therefore it has been felt necessary to facilitate the youth to become self-employed leading to income generation, wealth creation, and creation of further employment opportunities in rural and urban areas of the State.

Against this backdrop and in supersession of "Karmasathi Prakalpa", this new scheme is being introduced for the young entrepreneurs in the age group 18-55 years by offering subsidy linked and collateral free loans for setting up ventures/ projects/ micro enterprises in manufacturing, service and business/ trading/ agro based activities. In addition to subsidy as Margin Money the Government is additionally offering subsidized interest rate of 4% only per annum to the borrower on the Loan Amount for each project through Banks.

Salient features of the Scheme

Name of the Scheme : West Bengal Bhabishyat Credit Card Scheme (WBBCCS)

Area of the operation : Entire state - both urban and rural

Tenure : Five years from 1st April, 2023

Target coverage : 2 lakh youth in a year

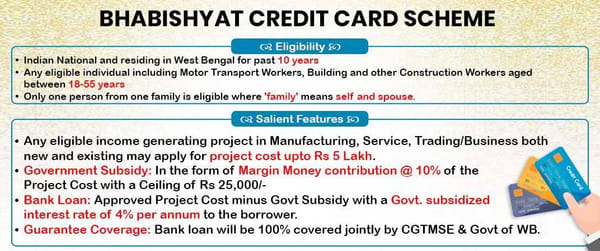

Eligibility:

Indian National and residing in West Bengal for past 10 years.

Any eligible individual including Motor Transport Workers, Building and other Construction Workers aged between 18-55 years.

Only one person from one family is eligible where 'family' means self and spouse.

Important Features:

Any eligible income generating project in Manufacturing, Service, Trading/Business both new and existing may apply for project cost upto Rs 5 Lakh.

Assistance under the Scheme:-

Only one person from one family is eligible where 'family' means self and spouse.

Government Subsidy:- In the form of Margin Money contribution @10% of the Project Cost with a Ceiling of Rs 25,000/-

Bank Loan:- Approved Project Cost minus Govt Subsidy with a Govt. subsidized interest rate of 4% per annum to the borrower.

Guarantee Coverage:- Bank loan will be 100% covered jointly by CGTMSE & Govt of WB.

Annual income family: No bar

Applicability:

Any income generating project in manufacturing, service, trading/business, farm sector (Diary, poultry, fish, piggery, etc.) qualifying as an enterprise under the extant definition of MSMED Act 2006.

Both new unit and existing unit can apply under the scheme for Term loan and/or working capital loan/composite loan. However, a new unit set up under this scheme may be considered for 2nd dose of capital support in machinery/tools or expansion only after two years of implementation.

All those applications that were sponsored under Karmasathi Prakalpa but not sanctioned as on 1st of April, 2023 will migrate to this scheme.

Non-applicability:

Employees of Central/ State Government/ Government Undertakings and their families will not be eligible to come under the purview of the Scheme.

Defaulter borrower in any Bank/Financial Institution.

Project cost: Up to Rs. 5 lakh

Assistance under the Scheme: Loan and government subsidy

Government subsidy: In the form of margin money contribution @ 10% of the project cost with a ceiling of Rs. 25,000

Bank Loan: The Bank loan component will be the project cost minus eligible govt subsidy in the form of Margin Money contribution

Guarantee coverage: The scheme shall have provision of credit guarantee coverage for the credit facility extended by Lending Institutions in collaboration with Credit Guarantee Trust Fund for MSEs ( CGTMSE). The extent of guarantee coverage of the State Government over and above the available coverage under CGTMSE wilI be as follows:

Category of the borrower

Maximum extent of Coverage (%)

CGTMSE (existing) provision

State govt %

Total

All eligible browsers

85%

15%

100%

Annual Guarantee Fee(AGF): CGTMSE wiII charge AGF a per norms on its share of guarantee coverage. However, there will no additional AGF for the additional guarantee coverage to be provided by the State Government.

Eligible Lending Institutions (L.I.) : All Scheduled Public Sector Banks, Private Sector banks, Regional Rural Banks, Small Finance Banks, Cooperative Banks and any other Lending Institution as may be prescribed.

Suggested modalities of the scheme :

14.1 Mode of application

Project proposals will be invited form the prospective and potential entrepreneurs in districts through advertisement.

The scheme will also be publicized in rural areas through Panchayati Raj Institutions

Online application through a dedicated portal to be developed for the scheme shall be made mandatory. No manual application will be accepted

Sponsoring of applications : Screened and complete applications will be sponsored to the banks within seven days on completion of screening.

Connect

Get in touch for personalized service solutions.

Support

pjcomputer2015@gmail.com

+91 8116198709

PJ COMPUTER © 2025. All rights reserved.

PRANABENDU JANA